The use of cryptocurrencies as an asset class for alternative investments has increased. Experienced and novice investors always seek fresh and innovative methods to assess and forecast their movements. One such approach is using the Dow Theory’s concepts, which were first developed for conventional stock markets. This essay will examine the relationship between cryptocurrencies and the Dow Theory and the ramifications for investors.

One of the first types of technical analysis is the Dow Theory, after Charles H. Dow founded Dow Jones & Company. It offers a framework for comprehending market movements and trends based on examining price action and market behaviour.

Basic Principles of Dow Theory

The Market Discounts Everything

Dow Theory states that the price of an asset reflects all available information in the market, including past, present, and future events. This principle highlights the effectiveness of markets in absorbing all available information into prices.

The Market Has Three Movements

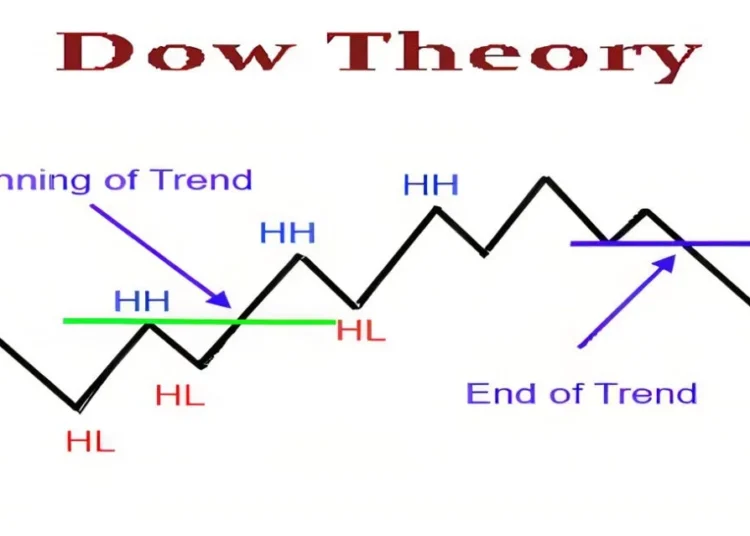

According to Dow Theory, there are three main patterns in the market’s movement: minor fluctuations, secondary trends, and fundamental trends. While secondary trends are movements opposite to the primary trend, the primary trend indicates the market’s long-term orientation. Short-term price changes inside the secondary trend are known as minor.

Trends Have Three Phases

Dow distinguished three stages within a trend: distribution, public engagement, and accumulation. When knowledgeable investors start purchasing or disposing of assets during accumulation, sentiment gradually shifts. As the pattern becomes increasingly apparent, investor interest increases throughout the public engagement phase. When smart money begins to sell during the distribution

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual money that run on decentralized networks powered by blockchain technology and employ encryption for security. Several of the most well-known cryptocurrencies on the market are Bitcoin, Ethereum, and Ripple.

Application of Dow Theory to Cryptocurrencies

Trend Identification in Cryptocurrencies

Finding main trends, secondary trends, and slight price variations are all part of applying Dow Theory to cryptocurrencies. Investors can use this study to determine the general direction of the Bitcoin market.

Importance of Volume in Cryptocurrency Markets

When it comes to verifying patterns in bitcoin markets, volume is vital. Increasing volume during price changes indicates a firm conviction among market players, whereas a fading trend may be indicated by falling volume.

Confirmation of Trends in Cryptocurrencies

Multiple indications, including price movement, volume, and market mood, must be analyzed to confirm trends in cryptocurrencies. Validation of the detected trend is provided by patterns that are consistent across these indicators.

Challenges and Criticisms

Volatility in Cryptocurrency Markets

Due to the extreme volatility of cryptocurrency markets, using conventional technical analysis techniques like Dow Theory might be difficult. Quick price changes can give investors incorrect signals and raise their risk.

Lack of Regulation

For investors, the absence of regulatory oversight in cryptocurrency markets adds even more uncertainty. The more uncontrolled environment in which cryptocurrencies operate, in contrast to traditional financial markets, may impact investor confidence and market dynamics.

Rapid Technological Changes

The rapid speed of technological improvements in the bitcoin field challenges long-term trend research. Novel advancements, like software modifications and procedure adjustments, have the potential to impact market dynamics and upend established patterns.

Benefits of Applying Dow Theory to Cryptocurrencies

By understanding the primary trends and identifying critical support and resistance levels, investors can better manage their risk exposure in cryptocurrency markets. Dow Theory provides a structured approach to risk management by emphasizing the importance of trend analysis.

Identifying Profitable Trends

Investors can benefit from applying Dow Theory to cryptocurrencies because it can assist them in recognizing profitable patterns and possibilities for investment. Investors can profit from price fluctuations in the market if they adhere to the concepts of trend analysis and confirmation.

Understanding Market Psychology

In addition, Dow Theory provides insights into the market’s psychology and investors’ behaviour. By examining market patterns and trends, investors can acquire a more profound comprehension of market sentiment and arrive at well-informed selections that are developed based on market dynamics.

Case Studies and Examples

Bitcoin Bull Run of 2017

During the bull run that Bitcoin saw in 2017, following the ideas of Dow Theory could have assisted investors in recognizing the primary uptrend, secondary corrections, and minor swings in price. Obtaining confirmation of the trend through volume analysis would have offered additional validation for the decisions made regarding trading.

Conclusion

The Dow Theory was initially developed for traditional stock markets; however, its concepts can be adapted to cryptocurrencies with certain modifications. In conclusion, the Dow Theory originated from conventional stock markets. By gaining an awareness of market trends, conducting volume analysis, and confirming patterns, investors can get valuable insights into the movements of cryptocurrency prices and make informed decisions on their investments.