The crypto market refers to the ecosystem of digital currencies, decentralized finance (DeFi) platforms, and blockchain technology. Bitcoin, the first and most well-known cryptocurrency, paved the way for thousands of altcoins, each with unique features and use cases. The market operates 24/7, allowing users to trade cryptocurrencies across the globe.

Recent Trends in Bitcoin and Altcoin Prices

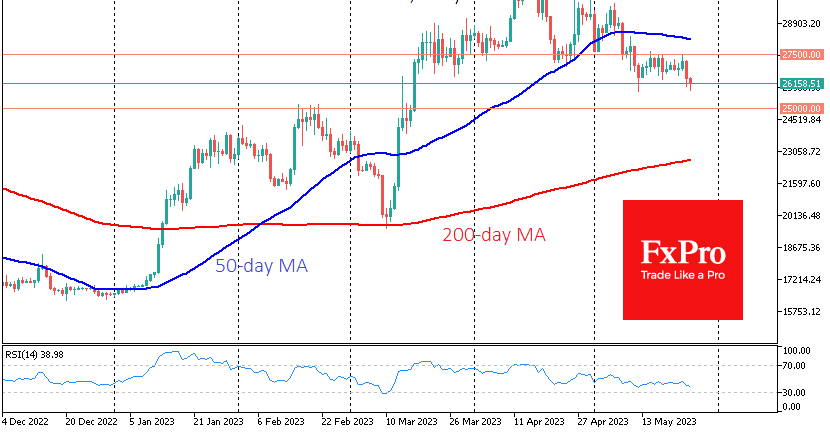

Bitcoin’s price reached historic highs in 2021, surpassing $60,000 per coin before experiencing significant corrections. Altcoins also experienced considerable price fluctuations, with some reaching all-time highs and others facing sharp declines. These trends have raised questions about the sustainability of cryptocurrency valuations.

Factors Influencing Crypto Market Volatility

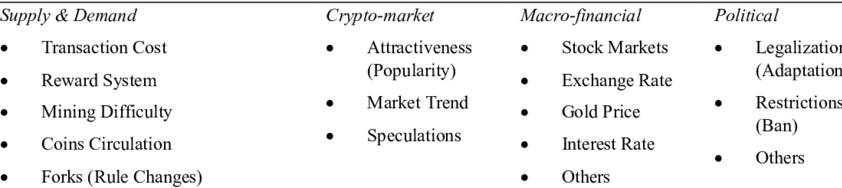

Several factors contribute to the volatility of the crypto market:

Regulatory Environment

Regulatory developments, such as government crackdowns on crypto exchanges or proposed legislation, can significantly impact market sentiment and prices.

Market Sentiment

Investor sentiment plays a crucial role in determining cryptocurrency prices. Joyous news, such as institutional adoption or technological advancements, can drive prices higher, while negative sentiment may lead to sell-offs.

Technological Developments

Innovations in blockchain technology and cryptocurrency projects can influence market dynamics. New protocols, decentralized applications (dApps), and network upgrades may attract investors or trigger market shifts.

Potential Headwinds for the Crypto Market

Despite its growth, the crypto market faces several challenges that could hinder its progress:

Regulatory Crackdowns

Increased scrutiny from regulators worldwide poses a threat to the crypto industry. Regulatory uncertainty may deter institutional investors and limit mainstream adoption.

Economic Uncertainty

Economic downturns or financial crises can impact investor confidence and trigger market volatility. Cryptocurrencies, often viewed as speculative assets, may experience heightened selling pressure during periods of uncertainty.

Competition from Central Bank Digital Currencies (CBDCs)

The rise of central bank digital currencies (CBDCs) presents a competitive threat to cryptocurrencies. CBDCs, issued and regulated by central banks, could offer similar benefits as cryptocurrencies while maintaining government control over monetary policy.

Strategies for Navigating Crypto Market Headwinds

Despite the challenges, investors can employ various strategies to mitigate risks and capitalize on opportunities:

Diversification

Diversifying your cryptocurrency portfolio across multiple assets can help spread risk and minimize losses during market downturns.

Risk Management

Implementing risk management techniques, such as setting stop-loss orders or allocating a portion of your portfolio to stablecoins, can protect against significant losses.

Long-Term Perspective

Taking a long-term approach to investing in cryptocurrencies can help weather short-term volatility and capture potential gains over time.

Conclusion

In conclusion, the crypto market faces uncertainty amidst regulatory challenges, economic factors, and competition from CBDCs. However, investors can navigate these headwinds by diversifying their portfolios, managing risk effectively, and maintaining a long-term perspective. Despite short-term fluctuations, the underlying potential of blockchain technology and cryptocurrencies continues to drive innovation and opportunities for growth.