For astute investors, finding “crypto gems”—assets with substantial growth potential but not yet generally acknowledged—can be a profitable venture in the quick-paced world of cryptocurrencies. It’s a good idea to scout the market as April approaches in order to find new chances and established players with promising career paths. This article explores the best cryptocurrencies to keep an eye on and maybe purchase in April, emphasizing their technological underpinnings, market positioning, and development potential.

Understanding the Market Dynamics

Prior to delving into certain assets, it is important to comprehend what qualifies a cryptocurrency as a “gem.” These consist of upcoming releases or updates, market demand, community support, technological innovation, and potential for adoption. The regulatory landscape and general market sentiment also have a significant impact on how cryptocurrency assets develop.

Top Crypto Assets to Watch

Bitcoin (BTC) – The Benchmark Standard

Even with its established reputation, Bitcoin is still an asset to keep an eye on. Being the first cryptocurrency, its fluctuations frequently influence the larger market. Bitcoin remains a staple investment due to its growing institutional interest and potential as an inflation hedge.

Ethereum (ETH) – The Platform for Decentralized Applications

Ethereum is positioned as a leading platform for decentralized apps (dApps) and smart contracts thanks to its continuous improvements, most notably the switch to Ethereum 2.0. By switching to a proof-of-stake consensus process, it hopes to improve scalability and lower energy usage, which might increase its utility and value.

Binance Coin (BNB) – The Exchange Token

BNB gains access to the platform’s vast ecosystem, which includes Binance Chain, Binance Smart Chain, and numerous DeFi and NFT projects, as the native cryptocurrency of Binance, the largest cryptocurrency exchange in the world based on trading volume.

Solana (SOL) – The High-Performance Blockchain

With its low transaction costs and great throughput, Solana has become a strong rival to Ethereum. Its potential indicates a promising future by making it a desirable platform for dApps, DeFi initiatives, and NFTs.

Cardano (ADA) – The Research-Driven Blockchain

With a strong emphasis on sustainability, scalability, and security, Cardano distinguishes out for its methodical development process and research-driven methodology. Smart contract implementation and continuous improvement could increase its attractiveness to developers and investors..

Polkadot (DOT) – The Interoperability Innovator

By facilitating communication and information sharing between several blockchains, Polkadot seeks to overcome a significant shortcoming in the present blockchain ecosystem. Its distinct parachain design offers tremendous development potential by potentially revolutionizing the way blockchains interact.

Chainlink (LINK) – The Bridge Between Real World and Blockchain

Linking smart contracts to real-world data is a crucial function of Chainlink’s decentralized oracle network. Because of its versatility across a range of applications—from insurance to DeFi—LINK is regarded as a significant asset in the blockchain industry.

Emerging Gems and Considerations

Decentraland (MANA) – Pioneering the Virtual Real Estate

Decentraland is a virtual reality platform that runs on the Ethereum blockchain and lets users develop, interact with, that make money off of apps and content. Its expansion may be fueled by the increasing interest in NFTs and virtual real estate.

Aave (AAVE) – Leading the DeFi Space

With the use of Aave, a decentralized lending protocol, individuals can lend and borrow cryptocurrency directly from one another. It stays at the vanguard of the DeFi movement thanks to its cutting-edge features, which include rate-switching and flash loans.

Cosmos (ATOM) – The Internet of Blockchains

Cosmos wants to build a network of blockchains that can communicate with one another, making it easier to move assets and data between chains. Its concept of a networked blockchain ecosystem presents significant growth opportunities.

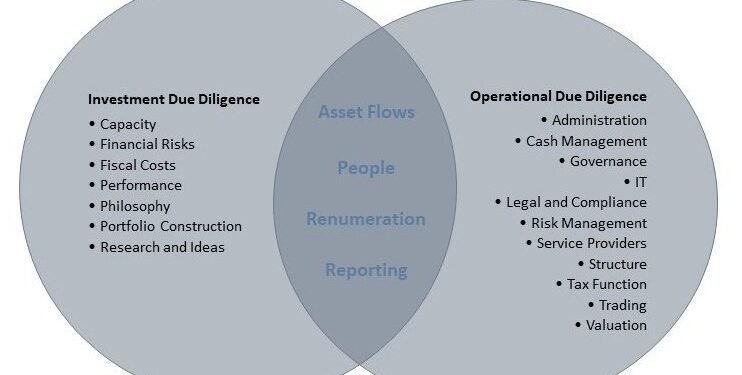

Risk Management and Due Diligence

Despite the substantial potential for large rewards, the bitcoin market is erratic and unstable. Before making an investment, it’s important to think about your risk tolerance and do extensive research. Important risk management techniques include diversification, comprehending the technology underlying each asset, and keeping abreast with industry developments and legislative shifts.

Conclusion

The bitcoin market is always changing, and there are always fresh possibilities to seize. The assets on the above list are a combination of well-known companies and bright rookies who could emerge as the next big cryptocurrency gems. Nevertheless, constant learning, attention to detail, and calculated decision-making are essential for profitable cryptocurrency investing. These assets are worth keeping a careful eye on as April progresses for investors who want to expand their holdings or get into the cryptocurrency space. Recall that finding cryptocurrency jewels can be a lucrative endeavor, but it also calls for perseverance, due diligence, and careful risk management.