The rise and fall of Sam Bankman-Fried once hailed as the ‘Crypto King’, has been a topic of intense discussion and analysis within the financial and tech communities.

His recent sentencing to 25 years in prison for fraud marks a significant turning point in the cryptocurrency industry and serves as a cautionary tale for the unregulated digital finance world.

This article delves into the background, the legal battles, the implications of his sentencing, and the future of cryptocurrency regulation.

Background: The Rise of Sam Bankman-Fried

Sam Bankman-Fried, commonly referred to as SBF, made a name for himself as a pioneering entrepreneur in the cryptocurrency space. He was the founder and CEO of FTX, a cryptocurrency exchange that quickly rose to prominence for its innovative trading options and user-friendly interface. SBF’s wealth skyrocketed along with FTX’s success, making him a billionaire and a central figure in the crypto industry.

The Fall: Unraveling the Empire

However, the seemingly unassailable empire began to crumble as investigations revealed extensive financial mismanagement and fraudulent activities within FTX. Allegations of using customer deposits for personal gains, risky investment strategies, and misleading investors and regulators led to a loss of trust. The situation escalated rapidly, culminating in FTX filing for bankruptcy, and SBF stepping down as CEO.

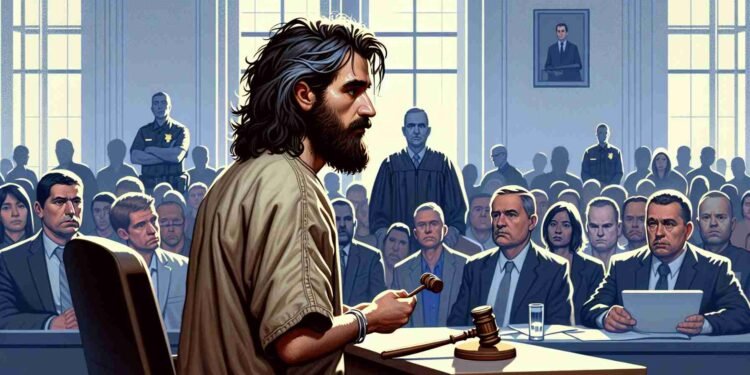

Legal Battle: The Road to Sentencing

Both crypto enthusiasts and critics closely watched the legal battle that ensued. SBF faced multiple charges, including wire fraud, securities fraud, and money laundering. The prosecution argued that SBF had orchestrated one of the largest frauds in financial history, deliberately deceiving investors and misusing funds.

The Defense Strategy

SBF’s defense team attempted to mitigate the charges by highlighting his attempts to cooperate with authorities and his previously unblemished record. They argued that the collapse of FTX was due to market conditions and poor business decisions rather than deliberate fraud.

Sentencing: The Fallout of a Crypto Empire

Ultimately, the court found SBF guilty of numerous charges, sentencing him to 25 years in prison. This sentencing marks one of the most significant legal actions taken against a figure in the cryptocurrency world and sets a precedent for how similar cases might be handled in the future.

Implications for the Cryptocurrency Industry

SBF’s sentencing has far-reaching implications for the cryptocurrency industry. It underscores the need for more stringent regulations and oversight to prevent fraud and protect investors. The case has sparked a broader discussion on the ethics and sustainability of cryptocurrency businesses, especially those operating in the largely unregulated digital space.

Balancing Innovation with Regulation

The challenge lies in balancing the need for innovation in the financial sector with the need for robust protections for investors. Regulators are tasked with crafting policies that prevent fraud while still allowing the cryptocurrency industry to flourish.

Conclusion: Lessons Learned from the Fall of a Crypto King

Sam Bankman-Fried’s journey from a celebrated crypto entrepreneur to a convicted fraudster serves as a powerful lesson for the cryptocurrency industry. It highlights the dangers of unchecked growth and the importance of transparency and regulation in the digital finance space. As the industry continues to evolve, the story of the ‘Crypto King’ will undoubtedly influence how cryptocurrencies are viewed, traded, and regulated in the years to come.

In sum, while SBF’s sentencing closes a chapter in the cryptocurrency saga, it opens another on the need for ethical leadership and rigorous oversight in the ever-expanding digital frontier. The legacy of his rise and fall will likely resonate for many years, prompting a reevaluation of how the world approaches cryptocurrency’s innovative yet volatile realm.