Within the sphere of Bitcoin, the pursuit of privacy has become an increasingly vibrant endeavor over the past several years. A growing number of issues regarding the anonymity and privacy of Bitcoin transactions are being raised as the cryptocurrency industry develops rapidly. The continued fight for Bitcoin privacy will be investigated in this article, which will also explore the technological developments, legislative hurdles, and the emergence of privacy-focused initiatives that influence the environment in 2024.

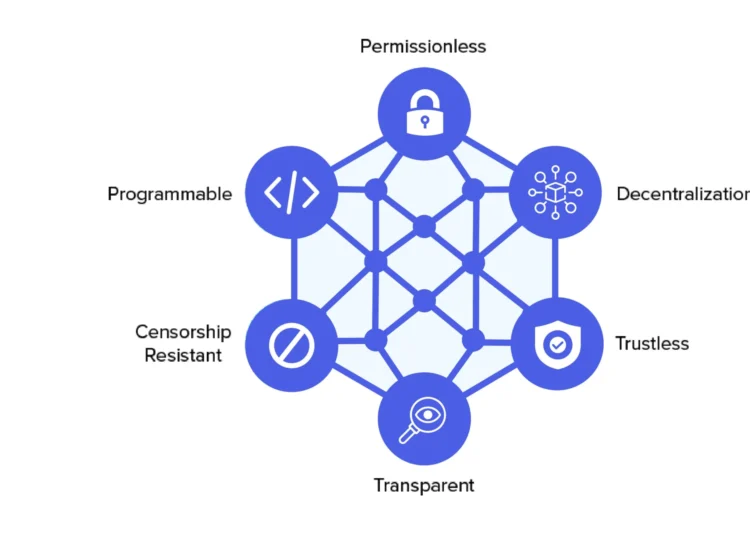

The pioneering cryptocurrency known as Bitcoin, established in 2009 by the pseudonymous Satoshi Nakamoto, was initially lauded for its decentralized nature and the possibility of anonymous transactions. On the other hand, the reality of Bitcoin’s transparency became readily apparent very quickly. Every transaction was recorded on the blockchain, an immutable ledger that anybody could view.

Evolution of Privacy Concerns in Bitcoin

Traceability of Transactions

The fact that transactions can be traced back to their origins is one of the most significant obstacles to privacy in Bitcoin. Although Bitcoin addresses do not immediately reveal the identities of users, advanced research tools can frequently correlate transactions to real-world entities, which can compromise users’ privacy.

Privacy-enhancing Technologies (PETs)

Many other privacy-enhancing technologies, often known as PETs, have come into existence due to these concerns. The purpose of these technologies is to conceal the data associated with transactions and to improve the privacy of Bitcoin users. CoinJoin, mixing services, and the construction of zero-knowledge proofs are examples of similar services.

Regulatory Landscape and Privacy in Bitcoin

The regulatory environment surrounding Bitcoin and other cryptocurrencies significantly impacts individuals’ right to privacy. The regulation of cryptocurrency transactions is becoming an increasingly important priority for government agencies worldwide. This is typically done to combat illegal activities like money laundering and financing terrorist organizations.

Government Regulations

Governments and regulatory agencies have implemented various initiatives to improve the transparency of cryptocurrency transactions and to increase surveillance of these transactions. Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are obligatory for cryptocurrency exchanges and financial institutions. This covers the implementation of these regulations.

Compliance Challenges

Individuals and enterprises within the Bitcoin ecosystem face hurdles when complying with these regulatory standards. An increasing number of users are concerned about the possibility of giving up their privacy in exchange for compliance, which has increased the tension between individual privacy rights and regulatory compliance.

The Battle for Privacy in Bitcoin

Technology vs. Regulation

The struggle for Bitcoin privacy might be characterized as a conflict between the application of technological innovation and the control of regulatory bodies. Regulatory pressures present significant obstacles to the general adoption of privacy-enhancing solutions, even those that are mainly focused on privacy continue to make progr

Privacy-focused Initiatives and Projects

Within the Bitcoin ecosystem, many initiatives and projects are dedicated to strengthening privacy despite the legislative difficulties that could be encountered. To provide consumers with a higher degree of control over their financial privacy, these efforts range from developing open-source software to creating cryptocurrencies with a focus on privacy.

The Rise of Privacy Coins

The use of privacy coins, a type of cryptocurrency designed to prioritize the anonymity of users and the privacy of their transactions, has been increasingly popular in recent years. Severaltures, like stealth addresses, ring signatures, and confidential transactions, are included in these currencies in otoceal transactional data information.

Challenges and Controversies Surrounding Privacy Coins

Regulatory Scrutiny

Much regulatory scrutiny has been directed toward privacy coins due to worries regarding the possibility that they could be used in illegal activities. To monitor and control transactions involving privacy coins, regulatory bodies worldwide have taken action, frequently focusing their attention on exchanges that handle these assets.

Criminal Activity Concerns

There are legitimate privacy benefits associated with privacy coins; nevertheless, there have also been instances where they have been linked to illegal activity, such as money laundering and ransomware payments. This linkage has contributed to the proliferation of unfavorable opinions and regulatory crackdowns on cryptocurrencies that are focused on privacy.

Decentralized Finance (DeFi) and Privacy

Privacy in DeFi Platforms

Platforms that provide decentralized finance (DeFi) services offer financial services without intermediaries, creating prospects for more intermediaries,is, there is no assurance that users will maintain their privacy when using DeFi because the blockchain makes transactions on various DeFi protocols publicly available.

Regulatory Implications

The convergence of decentralized finance and privacy presents regulators with a set of issues that are specific to the situation. There are concerns over regulatory monitoring and compliance with existing financial regulations raised by decentralized finance platforms despite these platforms offering unique solutions for financial inclusion and privacy.

Future Outlook: Balancing Privacy and Regulation

The fight for Bitcoin privacy may become more intense as technological innovation continues to outrun the responses of regulatory bodies. Finding a way to strike a balance between privacy and regulation will be necessary for the continued existence and widespread use of cryptocurrencies such as Bitcoin in the long run.

Conclusion

This war for Bitcoin privacy in 2024 is characterized by ongoing confrontations between the advancement of technology, the inspection of regulatory bodies, and the rights of users to maintain their privacy. The landscape is still shaped by regulatory issues and worries about illegal activity despite technologies that enhance privacy and provide intriguing solutions. As this discussion continues, it will become increasingly important to balance privacy and regulation to ensure the continued success of Bitcoin and the cryptocurrency ecosystem as a whole.