The revolutionary cryptocurrency garners media attention due to its constantly developing ecosystem. We will look into the most recent events today, with a particular emphasis on the BTC-Spot ETF market and its ramifications for cryptocurrency mining.

In recent years, Bitcoin has emerged as a phenomenon sweeping the globe, capturing the attention of investors and fans. As a result of its decentralized nature and the possibility of huge profits, Bitcoin has seen broad adoption and innovation in recent years.

What is a BTC-Spot ETF?

How does it work?

Importance in the cryptocurrency market

A big milestone for the cryptocurrency sector is the debut of BTC-Spot exchange-traded funds (ETFs). Institutional investors, who had previously been hesitant to enter the market due to regulatory uncertainties and security concerns, now have the opportunity to move forward with their investments. In addition to this, it improves liquidity and price discovery, which further legitimizes Bitcoin as a mainstream asset class.

The Rise of Crypto Mining

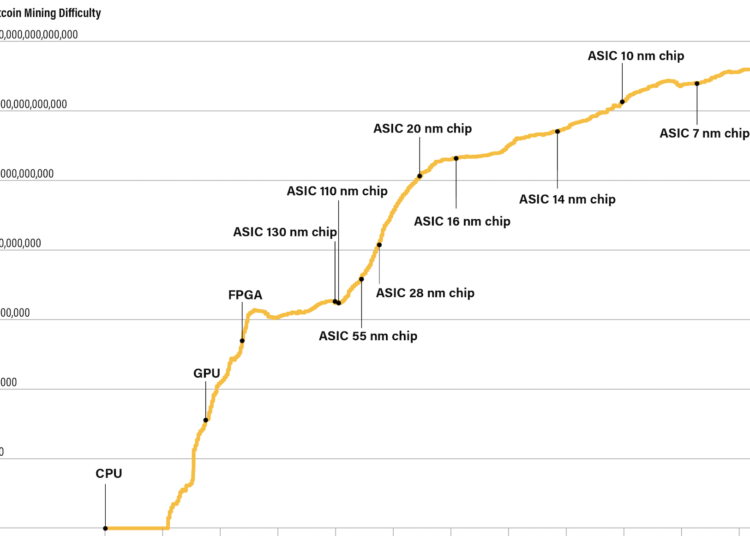

Cryptocurrency mining is an essential component to ensure the smooth operation and safety of blockchain networks. In exchange for newly created coins and transaction fees, powerful computers are required to solve difficult mathematical riddles, validate transactions, and ensure the network’s security.

Definition and significance

The creation of new bitcoins and the confirmation of transactions on the blockchain are both aspects of the process known as crypto mining. Miners are responsible for providing computational power to solve cryptographic challenges, preserving the network’s integrity and decentralization.

Types of Crypto Mining

The two basic methods used in cryptocurrency mining are the Proof of Work (PoW) and Proof of Stake (PoS) mining methods. Miners must solve difficult mathematical riddles to mine PoW using their processing power. At the same time, Proof-of-Stake (PoS) depends on validators, who are selected to generate new blocks based on the number of coins they possess and are prepared to “stake.”

Current trends and challenges

Despite its significance, cryptocurrency mining is confronted with several obstacles, such as rising energy usage, increased regulatory scrutiny, and higher levels of competition. The mining business is maturing, and miners need to adapt to the shifting market dynamics and technological improvements to continue to be profitable.

Impact of BTC-Spot ETF on Crypto Mining

Increased demand for Bitcoin

The launch of BTC-Spot exchange-traded funds is anticipated to result in a major increase in demand for Bitcoin, as institutional investors are looking to gain exposure to the cryptocurrency sector. There is a possibility that the increased demand would result in a jump in the price of Bitcoin, which could potentially increase the profitability of cryptocurrency mining operations.

Changes in mining profitability

Another factor that may affect mining profitability is the influx of institutional funding into Bitcoin. As the price of Bitcoin continues to grow, miners may see an increase in the amount of money they make from block rewards and transaction fees. However, this might also entice more members to the network, which would increase competition and decrease the proportion of rewards distributed to individual miners.

Regulations and Legal Implications

Governmental policies and regulations

It is important to note that the legislative climate surrounding Bitcoin and cryptocurrency mining varies from nation to nation. Some countries have shown a positive attitude towards blockchain technology and cryptocurrencies, while others have imposed stringent controls or outright banned them. The introduction of BTC-Spot exchange-traded funds (ETFs) may encourage governments to reconsider their attitude toward regulating cryptocurrencies, which may result in new regulatory frameworks to oversee ETFs and associated activities.

Potential impacts on investors and miners

Investors and miners need to maintain awareness of the latest regulatory developments and compliance standards to traverse the ever-changing landscape successfully. The market can be volatile and uncertain due to regulatory ambiguity, which can impact investment decisions and operational plans.

Future Outlook and Predictions

Speculations on ETF market growth

There is considerable space for growth and innovation in the BTC-Spot ETF industry, which is currently in its infancy-like stage. It is reasonable to anticipate a growth in the engagement of institutional investors and an expansion of product offerings to satisfy a wide range of market demands as more exchange-traded funds (ETFs) are introduced and regulatory clarity increases.

Evolution of the crypto mining industry

The cryptocurrency mining sector is well-positioned to undergo ongoing evolution and innovation, which will drive new technology developments and trends in the market. Due to the increasing popularity of Bitcoin and the increased level of competition in the mining industry, miners must adjust to new challenges and possibilities to retain their profitability and sustainability.

Conclusion

In conclusion, the cryptocurrency mining sector is well positioned to undergo ongoing evolution and innovation, which will drive new technological developments and trends in the market. Due to the increasing popularity of Bitcoin and the increased level of competition in the mining industry, miners must adjust to new challenges and possibilities to retain their profitability and sustainability.