Bitcoin has experienced a remarkable surge in value, capturing the attention of investors, analysts, and the general public alike. This surge, characterized by rapid price appreciation and heightened market activity, has sparked widespread curiosity and speculation. In this article, we explore the factors contributing to Bitcoin’s recent rally and the underlying dynamics shaping its trajectory.

Bitcoin, the world’s first and most well-known cryptocurrency, has a tumultuous history marked by dramatic price fluctuations and periods of intense volatility. However, in recent years, Bitcoin has gained increasing acceptance and legitimacy as a store of value and medium of exchange. The recent surge in Bitcoin’s value represents the latest chapter in its ongoing evolution.

Market factors driving Bitcoin’s rally

Relevant News: Bitcoin Briefly Rallies to Record High

One of the primary drivers behind Bitcoin’s recent rally is the growing institutional adoption of cryptocurrency. Institutional investors, including hedge funds, asset managers, and corporations, have begun recognizing Bitcoin as a legitimate asset class and allocating significant capital to digital assets. This influx of institutional money has provided a strong tailwind for Bitcoin’s price, driving demand and increasing prices.

Economic uncertainty stemming from inflation, currency devaluation, and geopolitical tensions has also fueled interest in Bitcoin as a hedge against traditional financial risks. As central banks worldwide continue to implement expansionary monetary policies and governments grapple with unprecedented fiscal challenges, investors increasingly turn to Bitcoin as a haven asset with a finite supply and decentralized nature.

Furthermore, regulatory developments, particularly in significant economies like the United States and Europe, have contributed to Bitcoin’s rally by providing clarity and legitimacy to the cryptocurrency industry. Regulatory frameworks that promote innovation while safeguarding investors’ interests have helped to instill confidence in Bitcoin and other digital assets, encouraging broader adoption and investment.

Technical factors influencing Bitcoin’s price

In addition to market dynamics, several technical factors have significantly driven Bitcoin’s price higher. One such factor is the Bitcoin halving, a programmed event that occurs approximately every four years and reduces the rate at which new Bitcoins are created. This scarcity mechanism, designed to mimic the scarcity of precious metals like gold, has historically led to supply shocks and subsequent price increases.

Moreover, the interplay between supply and demand dynamics and ongoing network upgrades and innovations has contributed to Bitcoin’s price appreciation. The increasing use of Bitcoin as a medium of exchange and store of value, coupled with improvements in scalability, security, and usability, has bolstered confidence in the long-term viability of the Bitcoin network and ecosystem.

Psychological factors affecting Bitcoin’s momentum

Beyond market fundamentals and technical indicators, psychological factors drive Bitcoin’s momentum. FOMO, or Fear of Missing Out, often leads investors to jump on the Bitcoin bandwagon during periods of rapid price appreciation, driving prices even higher in a self-reinforcing cycle.

Speculative trading and herd behaviour amplify Bitcoin’s volatility as traders and investors seek to capitalize on short-term price movements and market sentiment. Social media platforms and online forums also play a significant role in shaping perceptions and driving sentiment around Bitcoin, with influencers and celebrities often touting the virtues of cryptocurrency to their followers.

Comparison with previous bull runs.

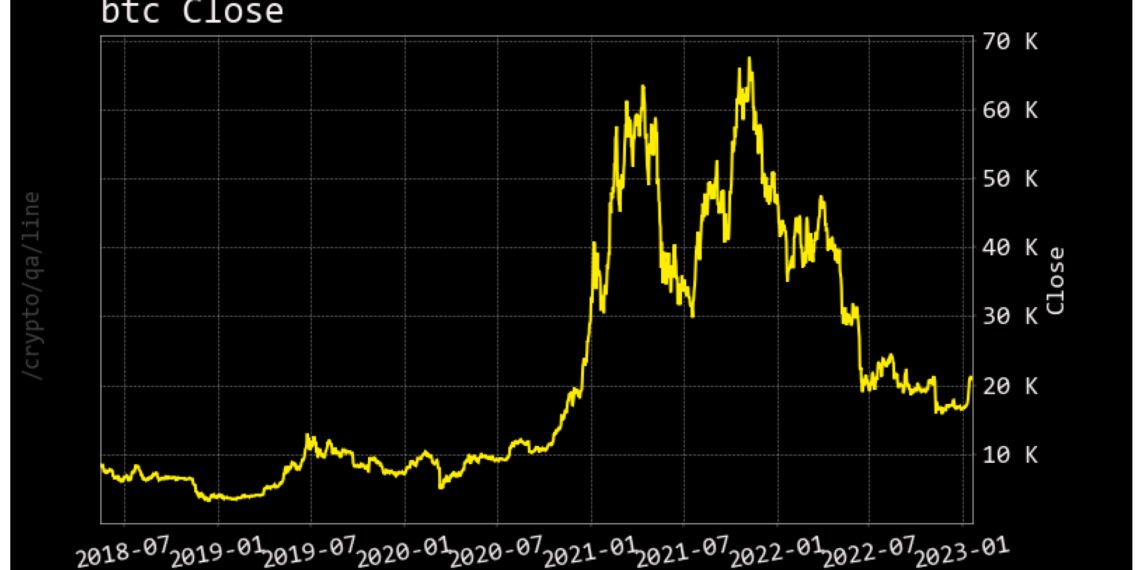

While the recent surge in Bitcoin’s price may seem unprecedented, it is similar to previous bull runs in Bitcoin’s history. The 2017 bull market, for example, saw Bitcoin’s price skyrocket to unprecedented highs before crashing back down to earth in a spectacular fashion. However, there are also notable differences, including market participants’ composition, infrastructure maturity, and the regulatory landscape.

Risks and challenges for Bitcoin’s future growth

Despite its meteoric rise, Bitcoin still faces numerous risks and challenges that could impede its future growth and adoption. Market volatility remains a constant threat, with prices susceptible to sudden downturns and corrections. Regulatory uncertainty, particularly in jurisdictions with restrictive policies towards cryptocurrency, could also pose significant obstacles to Bitcoin’s mainstream acceptance.

Moreover, Bitcoin’s underlying technology is not without its flaws, with scalability, security, and privacy concerns still being actively addressed by developers and researchers. The emergence of competing cryptocurrencies and blockchain platforms further complicates the landscape, raising questions about Bitcoin’s long-term relevance and dominance.

The long-term outlook for Bitcoin

Looking ahead, the long-term outlook for Bitcoin remains debatable, with proponents touting its potential to revolutionize finance and reshape the global economy. As Bitcoin matures and evolves, its role as a digital store of value, medium of exchange, and hedge against traditional financial risks is likely to become more pronounced.

However, challenges such as scalability, regulatory scrutiny, and technological innovation will undoubtedly shape Bitcoin’s trajectory in the future. Nevertheless, the underlying principles of decentralization, transparency, and censorship resistance underpinning Bitcoin’s ethos will likely endure, ensuring its continued relevance and resilience in an ever-changing world.

Conclusion

In conclusion, Bitcoin’s recent surge in value can be attributed to market, technical, and psychological factors. Institutional adoption, economic uncertainty, regulatory developments, and technical innovations have all played a role in driving Bitcoin’s price higher. While the future remains uncertain, Bitcoin’s resilience and staying power are undeniable, making it a fascinating and dynamic asset.

FAQs

- What caused Bitcoin’s recent surge?

- Bitcoin’s recent surge can be attributed to a combination of factors, including growing institutional adoption, economic uncertainty, and regulatory developments.

- Is Bitcoin a good investment?

- As with any investment, Bitcoin carries inherent risks and uncertainties. Investors should carefully evaluate their risk tolerance and conduct thorough research before investing in Bitcoin or any other cryptocurrency.

- How does Bitcoin’s price compare to traditional assets like gold and stocks?

- Bitcoin’s price is highly volatile compared to traditional assets like gold and stocks. While it has the potential for significant gains, it also carries a higher level of risk.

- What role does regulation play in Bitcoin’s price movement?

- Regulatory developments can significantly impact Bitcoin’s price movement, as they affect investor sentiment and market dynamics. Clarity and legitimacy in regulatory frameworks can bolster Bitcoin’s confidence, driving higher prices.